The Book

/The New Productivity Engine

The Compelling Impact of Financial Wellness in the Workplace

- Are you interested in workplace-based financial wellness?

- Do you prefer books that mix a statistical approach with stories about real life individuals?

- Are you either based at an employer or are you a practitioner who serves employees?

This book is right up your alley. The New Productivity Engine will help you understand how to address financial problems employees are experiencing. Check it out on Amazon.

Pages

Publisher

Language

USD

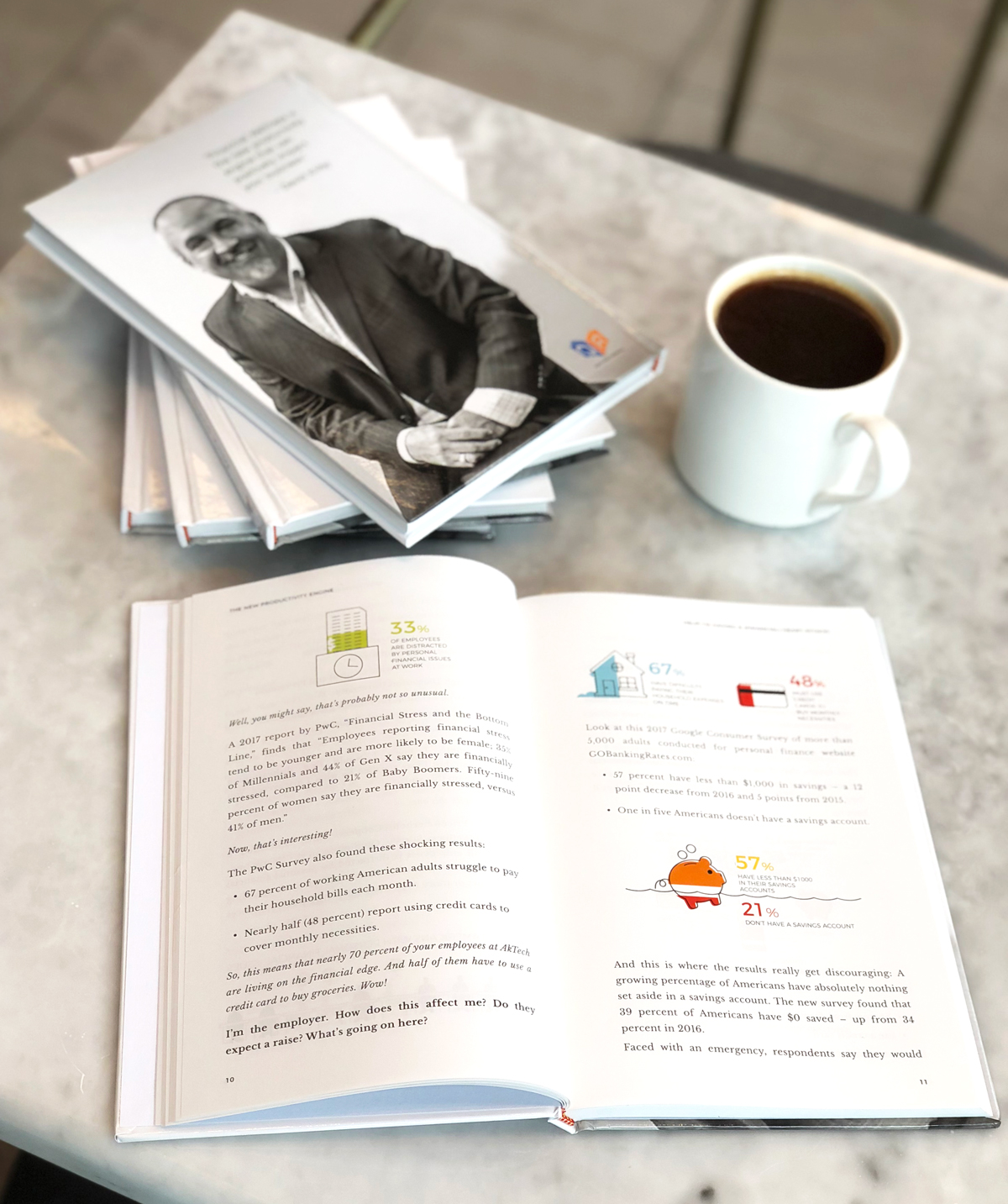

Businesses are perpetually concerned about improving worker productivity. David Kilby’s The New Productivity Engine outlines a different approach that employers can take to dramatically increase productivity, quickly solve financial problems, and increase employee satisfaction and retention at little to no cost. Kilby uses lively and believable real-life stories to showcase his innovative tactics. He cites national academic and business studies and media in his research. There are many visuals that demonstrate the challenge and solution.

“Employers in the U.S. are losing over $300 billion a year in productivity,” Kilby states, quoting notable sources. Over forty five percent of employees spend an average of two to three work day hours a week on personal finances. He cites ordinary problems like coming up with money for household bills, car repairs, emergency medical needs and sudden home repairs that can occupy workers’ minds, essentially taking them off the clock. He gives solid examples of how financial wellness programs can help stem that loss while engaging and stimulating employees at the same time. It can also eliminate 401(k) raids, difficult conversations about employer advances and other high cost, non-responsive solutions.

Kilby, who is president of FinFit, a national financial wellness platform, isn’t pushing his firm but rather the overall concept. He predicts that the financial wellness employee benefit will become as familiar and common in the workplace as health and retirement plans. “The really good news,” he says, “is that financial wellness platforms can actually generate measurable increased productivity that goes right to the bottom line and cost little to implement. This is a great read for any organization interested in the whats, whys and hows of implementing a financial wellness program.”